Raegen Selden, an office manager in Norristown, Pennsylvania, knows firsthand the costs involved in raising a family. With six children aged between 12 and 25, she has relied heavily on the federal Child Tax Credit since its introduction in 1997. During the pandemic, the credit was temporarily increased from $2,000 to $3,000 per child, and up to $3,600 for families with younger children. This enhancement played a crucial role in reducing child poverty in the U.S. by 46%, according to a 2022 Census Bureau report.

Selden appreciated the extra financial support, noting, “Bills still needed to be paid and things still needed to be bought. It was comforting to have that additional income.”

Raising a child from birth to age 18 is estimated to cost around $310,000, as reported by the Brookings Institution in 2022. Both presidential candidates have made increasing the Child Tax Credit a priority, though they have different approaches.

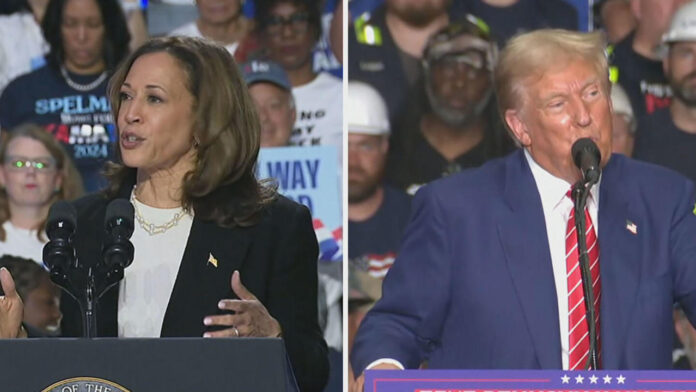

Trump’s campaign advocates for a $5,000 annual tax credit per child, proposing it be available to all families regardless of income. In contrast, Harris supports a credit of up to $3,600 per child, with an additional increase to $6,000 for newborns. Harris’s plan would limit the credit to low and middle-income families and make it refundable, meaning parents who do not owe taxes could receive it as cash.

Economics professor Melissa Kearney from the University of Maryland highlights the benefits of such measures, stating that evidence shows increasing income for low-income families with children significantly enhances their quality of life, including better educational and health outcomes.

The financial implications of expanding the credit have been a challenge, with a recent Senate bill to extend it failing.

Selden believes in the importance of the Child Tax Credit, emphasizing that supporting children is essential for their future contributions to society. “We want them to grow up to be great, productive citizens,” she said, “and it’s hard to do that if they can’t eat.”